Originally published Feb. 13, 2024 by TraderStef on CrushTheStreet (updated)

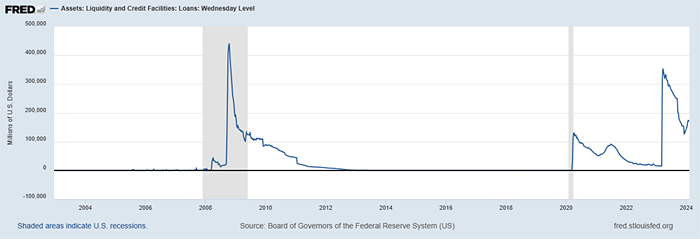

The commercial real estate (CRE) implosion has exposed endemic risk among regional banks and foreign financial institutions that adds fuel to a banking crisis bonfire that surfaced last spring after Silicon Valley Bank, Signature Bank, and First Republic collapsed. A liquidity crisis elicited a fire hose response from the Federal Reserve by launching a new Bank Term Funding Program (BTFP) to “support the stability of the broader financial system.” The Fed announced it plans to terminate that discount window on March 11, 2024.

“The Federal Reserve Board, on March 12, 2023, announced the creation of a BTFP… offers loans of up to one year in length to banks, savings associations, credit unions, and other eligible depository institutions pledging U.S. Treasuries, agency debt and mortgage-backed securities, and other qualifying assets as collateral. These assets will be valued at par.”

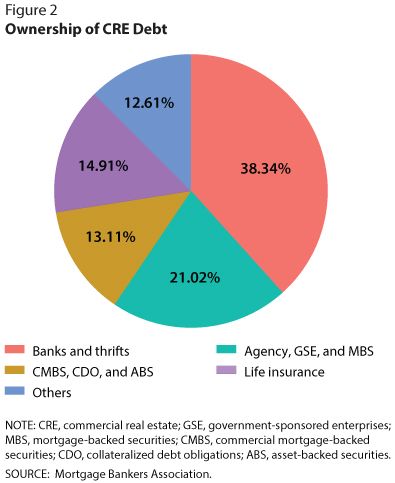

An issue most plebes are oblivious to is the smoldering CRE debt heap obfuscated by the synthetic securitization of commercial mortgage-backed securities (CMBS) within an overleveraged derivatives market. It is eerily similar to credit default swap (CDS) and collateralized debt obligation (CDO) tranches of mortgage-backed securities (MBS) that were the catalysts behind the infamous 2007-2009 Great Financial Crisis (GFC). There are no regulatory rules that standardize CMBS structures, and they are comprised of “commercial mortgages of varying terms, values, and property types” across the sector that include multi-family residential buildings. CMBS valuations are difficult to determine from a risk management perspective, which heightens the risk pool in the global derivatives market.

How the CRE Debt Crisis Spread to Banks… “Property mogul Barry Sternlicht last week said there’s $1.2 trillion of real estate losses in offices alone and ‘nobody knows exactly where it all is.’ Investors are growing alarmed that smaller banks might be on the hook for much of the wipeout… The turmoil is a blow for landlords and bankers who were waiting for lower borrowing costs to ease the pain, embracing the mantra of ‘Survive Til ’25’… Equity investors have been selling off regional bank shares since the New York Community Bancorp (NYCB) surprise, but credit investors seem sanguine… That said, CRE credit makes up more than 40% of some lenders’ loan books and the Fed is working with community and regional banks with concentrated exposures to commercial property. That includes coming up with a plan to work through expected losses… One reason for that is higher capital charges made CRE loans less attractive to the largest banks after the financial crisis. Smaller lenders that faced fewer capital requirements saw a chance to boost market share and piled in, increasing their exposure just as interest rates began to rise… The troubles with CRE are by no means limited to the U.S. Real estate is the industry accounting for the largest amount by far of distressed bonds and loans globally, much of it from China which has been in a property downturn for more than three years. Distress has also spread to Germany and the Nordic nations.” – BNN Bloomberg, Feb. 10

Commercial Real Estate: Where Are the Financial Risks?… “With CRE risks looming, a natural question is, Who is exposed if default in the CRE market occurs? In Figure 2, we show a breakdown of the major owners of CRE debt. Banks and thrifts are the largest direct holders, accounting for nearly 40% of CRE debt. These represent direct CRE holdings at banks, such as a loan for a mall or an office building. However, an additional 34% is held in mortgage-backed securities (both agency and commercial), which in turn tend to be securities held by banks. Therefore, when accounting for both direct and indirect holdings, banking institutions hold between 40% and 75% of all CRE debt, making them by far the most exposed institutions to CRE debt.” – Federal Reserve Bank of St. Louis, Nov. 2023

Investors are being sanguine and hoping that derivatives are much safer than during the GFC. If we revisit derivatives created during the GFC, a delinquency rate of roughly 8% in mortgage bond tranches was the target rate for institutions, private investment firms, and hedge funds to realize extraordinary profit by shorting the MBS and CDO market with CDS’. The current CMBS delinquency rate clocks in at 6.3% as of last month, which is more than triple YoY from 1.9% as calculated by Trepp.

The Big Short (2015) – Jared Vennett’s Pitch to Front Point Partners

Feel free to peruse “The Implosion of Commercial Office Space Has Begun” Part 1 published in May 2022, 2 in May 2023, and here’s an excerpt from 3‘s “Fire Sale” (Twitter thread) in Jul. 2023:

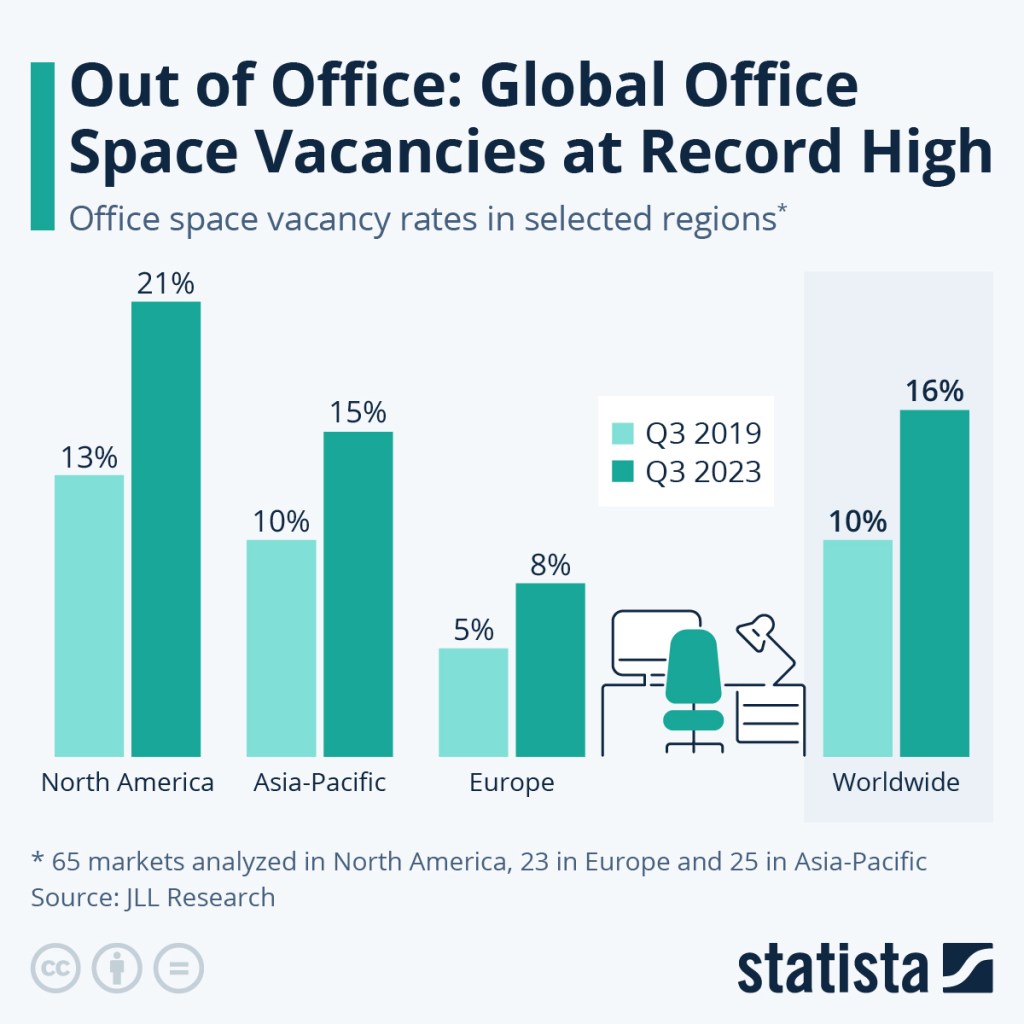

“The implosion of commercial real estate (CRE) sparked by office space vacancy rates during the pandemic and a remote work from home (WFH) culture has accelerated in several major metropolitan areas this summer. A study from researchers at New York University and Columbia University found that offices in the city will lose at least 44% of their pre-pandemic value by 2029 primarily due to the impact of WFH. Across the country, values for offices have decreased by 27% since March 2022 according to data analytics company Green Street. Despite what the disastrous ‘Bidenomics’ hopium narrative is selling, the U.S. economy is tumbling toward another Great Recession scenario. Numerous sources have cited since 2022 that the CRE market was the ‘next shoe to drop.’” – TraderStef

We must ask ourselves how exposed the regional banks are that currently hold zombie CRE debt. In the last entry of this series, examples of office buildings and mixed-use CRE were cited as “fire sales.” Has the implosion plateaued, or is it worsening in our nation’s metropolises or abroad? Consider the three following domestic examples from this year:

$59M mortgage on 1515 Market St. sent to special servicing as woes mount for city’s office market… “The 20-story building at 1515 Market St. joins a growing list of distressed office properties surrounding City Hall in Philadelphia.” – Philadelphia Business Journal, Feb. 6

A 262k sq ft building in Ohio has just sold for $2.4 million, or $9 per sq ft… “Yes, that’s not a typo – it literally sold for $9 per sq ft. It was the former site of FedEx Custom Critical in Green, Ohio. The commercial real estate ‘correction’ has gone from concerning to an outright apocalypse, primarily impacting office properties in most cities across the U.S.” – TripleNetInvest, Feb. 9

A once prime and bustling retail/office building in Chicago downtown recently sold at a huge ~60% ‘discount’… “The 5-story building located on S. State St. sold for $15 million. What did it sell for in 2015? $35 million by Tishman Realty and AXA Group. To make matters worse, the sellers spent several millions renovating the building under their ownership. The first two floors are fully occupied with retail tenants including Champs Sports and Capital One Café. The property’s other three floors are office, and only one of the floors is occupied. The commercial real estate landscape in Chicago has gone from scary to cataclysmic in many parts of the city and there seems to be little stopping the pain.” TripleNetInvest, Feb. 10

New York Community Bancorp (NYCB) is a regional bank that dominated financial press headlines last week after reporting a bucket of issues within its CRE book that includes hot garbage from Signature Bank assets it purchased from the FDIC. The bad news included $185 million in net charge-offs for 4Q23, and it set aside a paltry $552 million in loan loss reserves for future CRE pain despite its staggering $3.4 billion exposure to office building loans.

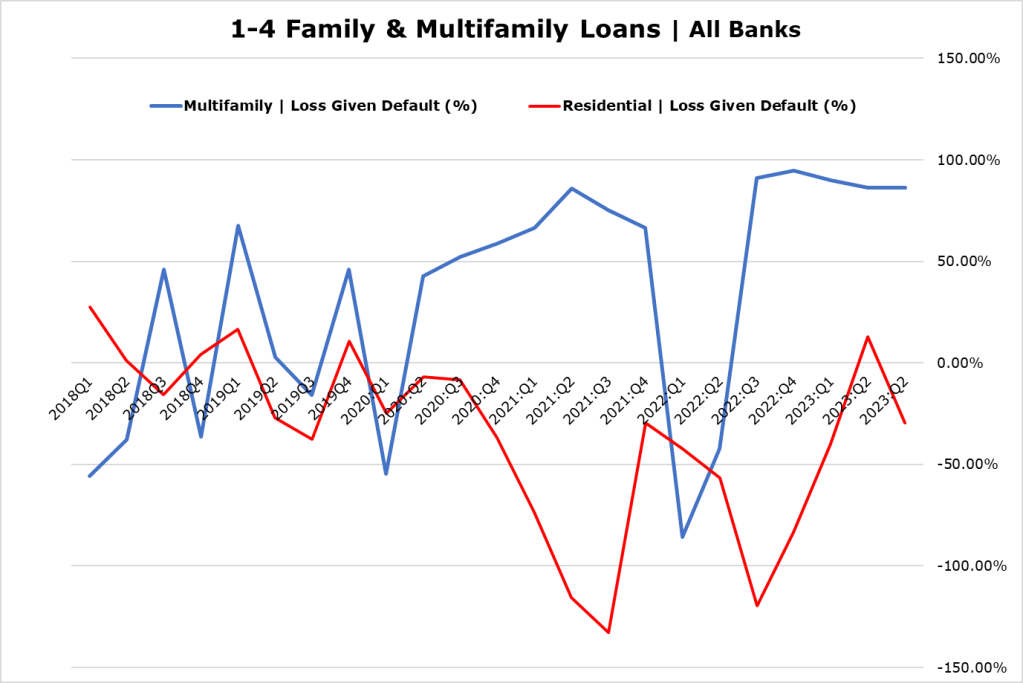

Shaky CRE loans threaten new regional bank crisis… “Almost a year after the failure of three midsized U.S. banks sparked an industry crisis, investors and regulators are once again bracing for turmoil among regional lenders, this time due to rising defaults in commercial mortgages.” – Liz Hoffman, Feb. 8“Like we said a year ago. Commercial real estate is glacial. Rejects the narrative demand for immediate resolution. Imagine losing an average of 85% of the loan amount post default on apartment buildings that went up and up for a century.” – RCWhalen, Feb. 9

On the foreign front, Japan’s Aozora Bank disclosed it had $1.9 billion in U.S. office loans in major cities that account for 6.6% of its loan book. The stock shares plunged with soaring short interest because its fate is precarious “amidst a deepening crisis that could reshape global finance.” Canada’s Imperial Bank of Commerce (CIBC) is exploring offloading its $316 million exposure in U.S. office loans after earnings were hit by higher provisions for credit losses. CIBC stated they have “focused on diversified industries and much less on institutional real estate.” Europe’s Deutsche Bank more than quadrupled its loan loss provisions for U.S. CRE to $132 million vs. $25 million last year while Germany’s capital flows into U.S. CRE dropped significantly. German institutions invested $1.2 billion in U.S. real estate from 3Q22 to 4Q23, an 85% plunge from $8 billion in 3Q21 to 2Q22 when interest rates were zero-bound. Rising distress in Germany’s economy and exposure to the U.S. CRE market is signaling credit investors that there’s “more than a temporary blip.”

The decline is not just about rising interest rates because open-ended funds are concerned over retail investor redemptions and a higher cost of hedging between the dollar and euro. European banks are estimated to have 1.4 trillion euros ($1.5 trillion) in loans to the CRE industry amid a steep fall in office prices on both sides of the pond. Big players are not thrilled about current market conditions, have concerns about lenders’ ability to handle the risk, and do not want to be cornered into catching a “falling knife.”

US Commercial Real Estate Remains a Risk Despite Investor Hopes for Soft Landing… “These challenges are particularly daunting as high volumes of refinancing are coming due. According to the Mortgage Bankers Association, an estimated $1.2 trillion of commercial real estate debt in the United States is maturing in the next two years. Around 25% of that is loans to the office and retail segments, most of which is held by banks and commercial mortgage-backed securities… Financial intermediaries and investors with a significant exposure to commercial real estate face heightened asset quality risks. Smaller and regional US banks are particularly vulnerable as they are almost five times more exposed to the sector than larger banks. The risks posed by the commercial property sector are also relevant for other regions, for example, in Europe, as many of the same factors are at play as in the US.” – IMF, Jan. 18

National vacancy rates have worsened with a record-breaking 19.6% in 4Q23 according to Moody’s Analytics, which is the largest quarterly increase since 1Q21, higher than the previous record at 19.3% in 1986 and 1991.

Are Banks Beginning to Choke on Their Commercial Real Estate Exposure?… “Remember, as rates go up, bond prices fall. Thus, courtesy of the Federal Reserve’s rate hikes over the last two years, banks still have a disgusting number of unrealized losses from investments – a staggering $700 billion worth as of Q3-2023… ‘synthetic securitizations’ have started to make their way into the US market as banks search for ways to manage their capital constraints… Think of things like credit default swaps, credit guarantees, or other derivatives contracts to try and ‘hedge’ losses (aka shift the risk around).” – Speculators Anonymous, Feb. 12

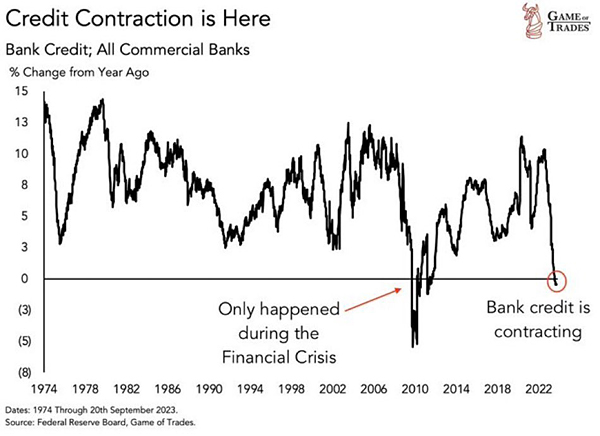

A hefty chunk of CRE loans mature this year and next that must be renegotiated, extended, or refinanced at higher interest rates. The stark rise in delinquencies, defaults, and foreclosures will likely restrict lending standards further, trigger additional contagion, cause less liquidity in the financial system, and falling valuations all portend a larger spillover into the economy.

Meanwhile, the Fed has not only telegraphed interest rate cuts at FOMC meetings since Nov. 2023, but yesterday’s headline reported the Fed is about to phase out quantitative tightening (QT) monetary policy that was implemented in spring 2022. A reversal on both fronts screams that the Fed is very concerned about ongoing CRE risk, a potential for derivatives chaos, fears over upcoming Treasury debt auctions at higher rates to finance the $34.2 trillion U.S. national debt, payment of annual interest at $1 trillion, around $210 trillion in unfunded liabilities, and the out-of-control fiscal policy on Capitol Hill has been described for years by Fed Chairman Jay Powell as “an unsustainable path.”

Irony Alert: “Outlawing” Recession Has Made a Monster Recession Inevitable… “The mainstream view is that recessions are bad, so let’s make sure they never happen. In other words, let’s outlaw them by flooding the economy and financial system with Federal Reserve monetary stimulus and federal stimulus via increased deficit spending. The history of the past 40 years ‘proves’ these policies effectively eliminate recession: all recessions since 1981-82 have been shallow and brief, basically a spot of bother that lasts one quarter.” – Charles Hugh Smith, Feb. 7

CRE Derivatives = The Next Financial Crisis – ITM Trading, Sep. 2023

Plan Your Trade, Trade Your Plan

Headline Collage Art by TraderStef

Not a Financial Advisor: None of the content produced by TraderStef™, staff members, or any services associated with this website should be construed as financial or investment advice. Financial investment is a risky endeavor and may lead to substantial loss. Always perform due diligence before undertaking any financial decision – Copyrighted Material: A “by TraderStef” credit linked back to this website is required when using any quotes, technical analysis charts, or publishing a partial version of an article.

3 thoughts on “The Implosion of Commercial Office Space Has Begun – Part 4: Derivatives”

Comments are closed.