Welcome to a precious hour of time well spent for news gormandizers that keep a finger on the pulse of global markets for risk management in trading or investment portfolios. The blog features fusion technical analysis for the investor or trader that follows gold and silver, precious metals mining stocks, general stock market equities and indices, and thoughtful commentary on current affairs that overlap financial market conditions.

A trading workshop focused on technical analysis for one-on-one and groups is available in a webinar-style remote room to explore new strategies for the investing toolbox, especially for beginners or the intermediate level trader/investor. You will find realistic and reasonable analysis focused on profit and capital preservation based on market conditions and price action with proven methods to execute low-risk entries.

Exclusive articles or charting are available by request. An archive of interviews and miscellaneous topics found in the blog are on YouTube. In the meantime follow @TraderStef on X for real-time updated charts and commentary, peruse my bio, and add an email address for article notifications via the “follow” button on the right sidebar. All are welcome to reference charts or quotes with a credit linked back to this website. The most recent technical analysis was “Gold and Silver Chart Update for Early Fall 2025” published (X thread) on Oct. 6, 2025. The most recent live talk-radio interview was in Apr. 2022 as I’m on hiatus from interviews but plan to return.

- Gold Spot all-time high $5,597 oz on Jan 29, 2026 – currently consolidating

- Silver Spot ATH $121.55 oz on Jan 29 ($121 call out on Jan. 26) – currently consolidating

- Coin Counterfeit Detection: NGC and Modern Coin Mart articles, DefyTheGrid Video

- ABC’s of Coin Grades (i.e. Bright Uncirculated vs GEM) – Susan Headley

- What is Physical $ Premium over Paper Spot Price (How to Manually Calculate)

- Bullion dealers: Texas Precious Metals | Miles Franklin | Modern Coin Mart | Defy the Grid

Gold Spot daily chart Jan. 21, 2026, 6am ET (X thread) – mouse over/select to enlarge….

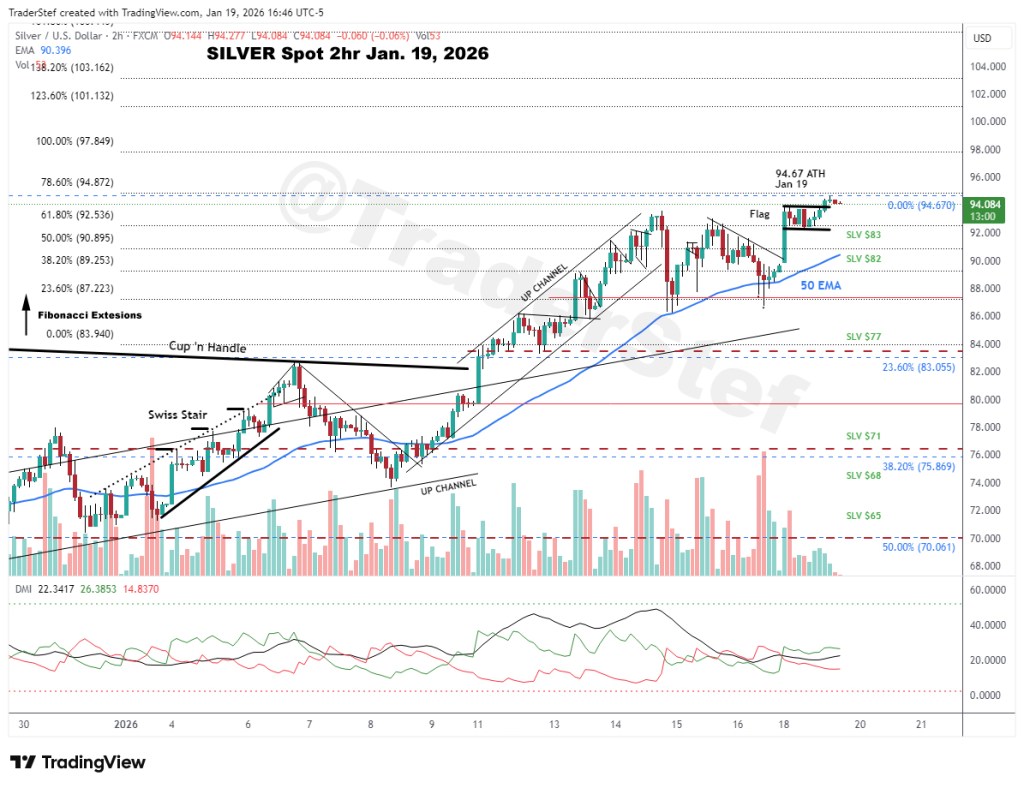

Silver Spot 2hr chart Jan 19. 2026, 5pm (X thread)…

Gold Spot Monthly w/Fibonacci Extensions, Secular Bull – 1999 to Apr. 5, 2024 close…

Gold Spot Monthly Aug. 1999 Low – Apr. 11, 2025 Close: % Gain vs. Dollar, Dow, S&P, Nasdaq, Russell

Thanks for stopping by!

Plan Your Trade, Trade Your Plan

Headline Collage Art by TraderStef / Screenshot From “Paper Moon” (1973)

You must be logged in to post a comment.