Originally published Nov. 19, 2023 by TraderStef on CrushTheStreet (updated)

An increasing number of Americans cannot afford the higher car prices and are falling behind on record-high car payments, which adds more misery to tighter household budgets as the U.S. economy heads for a hard-landing recession after a pandemic, supply chain crisis, rampant inflation, and the Federal Reserve’s interest rate hikes. It was reported last month that 60% of Americans are living paycheck to paycheck. Subprime auto loans are of particular concern because they are being securitized into asset-backed securities (ABS) derivatives that are sold to pension funds and institutional investors at relatively low yields. “That works until it doesn’t, and now it doesn’t.” It is reminiscent of mortgage-backed securities (MBS) that were responsible for the infamous Great Financial Crisis (GFC) that erroneously blamed the housing bust and banking crisis on subprime peasants.

Record number of car buyers paying $1,000+ per month amid low vehicle inventory… “‘The double whammy of relentlessly high vehicle pricing and daunting borrowing costs is presenting significant challenges for shoppers in today’s car market,’ said Ivan Drury, Edmunds’ director of insights. ‘The Federal Reserve’s recent pause in interest rate hikes, unfortunately, didn’t offer much relief for consumers, and hints at further raises later this year mean auto loan rates could even continue to increase.’” – Detroit Free Press, Jul 3, 2023

Subprime Auto Bondholders Face Possible First Hit in Decades… “The collapse of two US auto dealers and a growing pile of delinquent car loans are threatening to deliver losses in a corner of Wall Street that, until now, has been a sea of calm: the asset-backed securities market.” – Bloomberg, Jul. 5

Monthly payments for new cars have spiked by 28% in the last three years with prices averaging $47,936 last month according to Kelly Blue Book. The used car supply is thin, and prices have barely fallen, with an average used car selling for $26,533, which is only 3% lower than last October.

The Car Market is Collapsing – Here’s Why – Flying Wheels NH, Nov. 20

My last look at car affordability and auto loans was with “New Car Sales Plunge as Affordability Tanks and Repos Spike” published in July of 2022. Here is an excerpt:

“After the Federal Reserve initiated quantitative tightening (QT) in late fall of 2017, I published ‘96-Month and Subprime Auto Loans – It is All Good Until…’ in May of 2018. Household debt was at an all-time high, the Fed was raising interest rates at .25% increments while reducing its $4.5 trillion balance sheet blowout from the Great Financial Crisis, and traditional auto loans were morphing into much longer payment terms. The issue with a long payment plan is that a vehicle depreciates faster than the value of its outstanding loan balance, creating an underwater loan-to-value ratio… In mid-summer of 2019, the Fed pulled a Taper Caper by announcing an earlier than expected end of QT and launched an unprecedented REPO program in Sep. of 2019 to address a growing liquidity crisis in international banking… The U.S. fiscal and monetary policy response to the pandemic and subsequent additions to the CARES Act delayed financial risks that were baked in the cake with astronomical household debt, concern over the national debt that has reached $30.5 trillion, and then we have that auto loan bubble.” – TraderStef

Since the potential government shutdown was temporarily averted last week until Jan. 2024 with another continuing resolution on Capitol Hill, most folks are probably aware that our national debt is accelerating and just shy of $34 trillion without a budget or debt ceiling. The Fed’s launch of QT in the spring of 2022 included interest rate hikes at an unprecedented pace that skyrocketed annual interest payments beyond $1 trillion, which is covered in “Annual Interest Due on U.S. Sovereign Debt Surges Above $1 Trillion” published last week. The substantial rise in rates pummels consumer financing in all categories of a record household debt pile already in the pipeline. The current Bidenomics economy unfolding has surged consumer credit card balances with the “largest yearly leap on record” as they fall behind on payments with no personal savings. Delinquencies on auto loans are beginning to multiply.

- Total Household Debt Reaches $17.29 Trillion in 3Q23 – Federal Reserve

Rising interest rates, car prices trigger peak in delinquencies – Straight Arrow, Oct. 25

Auto Loan Delinquency Rates Reach Highest Level Since 1994… “The percentage of subprime auto borrowers at least 60 days past due on their loans reached 6.11% in September, the highest level since 1994, the report said, citing data from Fitch Ratings… While interest rate hikes have made newer loans more expensive, other factors such as higher car prices and borrowing costs have also contributed to the problem.” – PYMNTS, Oct. 22

Americans falling behind on auto loan payments at record pace… “In fact, the percentage of consumers paying at least $1,000 a month for a vehicle surged to 17.1% in the second quarter of 2023 – an all-time high and up from 16.8% at the start of the year, according to data from Edmunds. That also raises the threat of trouble ahead in the auto industry should more consumers continue to default on their loans. Rates are expected to remain elevated as the Federal Reserve has hinted that it may hold interest rates at peak levels for longer than previously anticipated.” – Fox Business, Oct. 25

Auto Loan Balances, Interest Rates, Subprime Delinquencies, Cash Buyers, Tight Credit: How Are our Drunken Sailors Holding Up?… “Subprime is only a small part of the auto-lending business, and an even smaller part of the auto-sales business because lots of people pay cash. Of those buyers that finance new vehicles, only about 5% are subprime; and of those that finance used vehicles, 22% are subprime, according to Experian. And subprime loans that are at least 60 days delinquent spiked through September. But prime loans are rock-solid with minuscule and stable delinquency rates below pre-pandemic, according to Fitch.” – Wolf Street, Nov. 8

“Are Trust Fund babies buoying car prices? Nearly 1 in 3 car buyers in today’s market are paying *all cash* for their purchase (very high). But here’s the ironic part: Gen-Z is leading the charge. They’re acquiring cars as ‘gifts’ at record numbers.” – CarDealershipGuy, Nov. 14

A must-read on how ABS derivatives are playing a role in the current auto-lending business and banks’ exposure was published by Bloomberg in “How Wall Street Makes Millions Selling Car Loans Customers Can’t Repay.” Lenders such as Santander are profiting while borrowers are paying up to 29.99% interest. Car dealers (see @CarDealershipGuy’s Twitter post “MAKING MILLIONS FROM SUBPRIME LOANS” and the full YouTube version starting at timestamp 34:54) and lenders claim they are “throwing a lifeline to customers” with bad credit that need transportation. The following 30-minute Bloomberg podcast summarizes the investigation:

Wall Street Sells Car Loans Customers Can’t Repay – The Big Take, Nov. 15

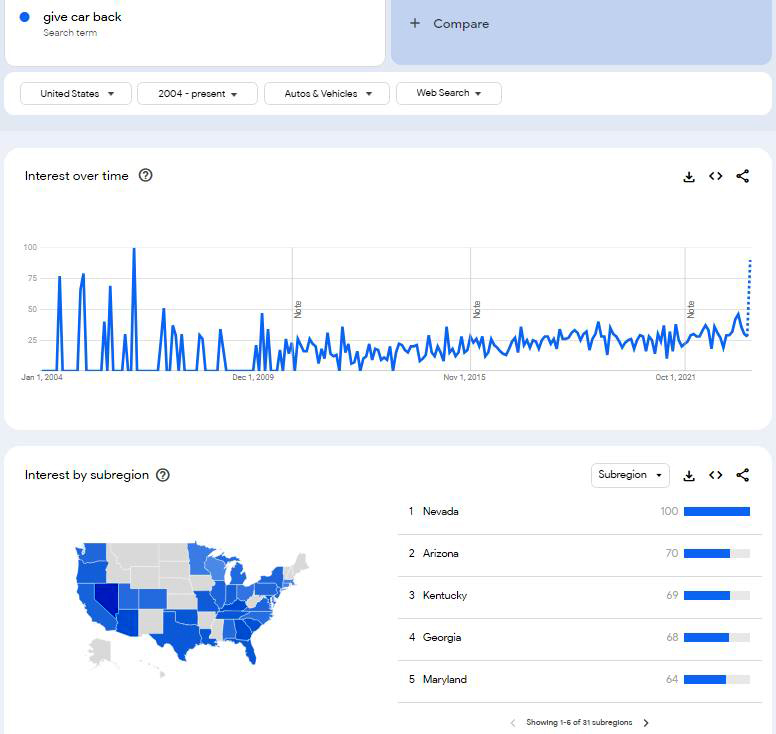

An anomaly making rounds in the financial press found that searching for the phrase “give car back” with Google’s trends tool has a thought-provoking result. Today’s printout for the U.S. shows the phrase spiking well above the GFC era when giving your house keys to the bank was a wise solution.

“During the GFC, many people forfeited their homes but held onto their Toyota Camrys. In 2023, it’s reversed: 14.2% of auto loans rejected (highest rate ever recorded) 6.1% of subprime auto borrowers 60+ days overdue (also a new record).” – Hedgeye, Oct. 25

For now, if you have a car that is fully paid for and in good running condition, keep that Betsy maintained rather than taking on a car loan or draining savings for a cash purchase.

Terry McMillen – GoPro on NHRA Top Fuel 2015 Finish

Plan Your Trade, Trade Your Plan

Not a Financial Advisor: None of the content produced by TraderStef™, staff members, or any services associated with this website should be construed as financial or investment advice. Financial investment is a risky endeavor and may lead to substantial loss. Always perform due diligence before undertaking any financial decision – Copyrighted Material: A “by TraderStef” credit linked back to this website is required when using any quotes, technical analysis charts, or publishing a partial version of an article.

You must be logged in to post a comment.