Originally published Nov. 9, 2023 by TraderStef on CrushTheStreet (updated)

The unsustainable U.S. national debt and deficit burden (view the real-time National Debt Clock) is a theme within my series on an impending bond storm ouroboros, the housing bubble’s entry into a capitulation phase, an imminent hard-landing recession vs. a Goldilocks economy narrative, and the fire-sale stage in a post-pandemic commercial real estate (CRE) implosion with bankruptcies rippling across the industry amid a growing banking crisis.

- New Study Shows Nearly 190 Banks on Verge of Collapse – FrankNez, Aug. 2023

- Monetary Tightening & U.S. Bank Fragility in 2023 – SSRN White Paper, Sep. 29

- Treasury Auctions Explained – Quote the Raven, Nov. 10

I explored a financial crisis in the making when I penned “Three (Four) Bankers of a Financial Armageddon Salvage Operation” in Sep. 2018. At that time, Ray Dalio of Bridgewater Associates was making the rounds on legacy financial media to discuss how the next debt crisis and economic downturn would be more difficult to handle socially and politically. Here he is squawking on CNBC:

Since the Federal Reserve launched its quantitative tightening (QT) monetary policy and began raising interest rates in 1Q22 at an unprecedented pace to tame rampant inflation, expenditures to service Treasury debt that finances U.S. sovereign debt skyrocketed. Note that annual interest paid on the national debt in 3Q09 was $352.317 billion when Lehman Brothers imploded and $508.545 billion in 3Q20 in the first shutdown during the pandemic panic. Data published at the St. Louis Federal Reserve printed a $981.305 billion figure as of Oct. 26, 2023:

What transpired at the end of last month was headlined by analysts at Bloomberg yesterday:

US Debt Interest Bill Rockets Past a Cool $1 Trillion a Year… “Estimated annualized interest payments on the US government debt pile climbed past $1 trillion at the end of last month… doubled in the past 19 months… The gauge of estimated interest costs is different than what the Treasury actually paid. Interest costs in the fiscal year that ended Sept. 30 ultimately totaled $879.3 billion, up from $717.6 billion the previous year and about 14% of total outlays. But, looking forward, the rise in yields on long-term Treasuries in recent months suggests the government will continue to face an escalating interest bill…

The worsening metrics may reignite debate about the US fiscal path amid heavy borrowing from Washington. That dynamic has already helped drive up bond yields, threatened the return of bond vigilantes, and led Fitch Ratings to downgrade US government debt in August. ‘There will be further increases to Treasury coupon auctions and T-bills outstanding going forward… Besides deficits of over $2 trillion in the foreseeable future, climbing maturities following the increase of issuance from March 2020 will also need to be refinanced.’” – Yahoo Finance, Nov. 7

- Moody’s cuts U.S. outlook to negative, citing deficits and political polarization – CNBC, Nov. 10

When the Federal Reserve began aggressively hiking interest rates, it jacked up the cost of credit across the entire economy, and the U.S. government was not exempt. Former Treasury Secretary Larry Summers chimed in on the current debt crisis during an event last month at the Center for American Progress, a Democrat-aligned think tank.

With the U.S. budget deficit clocking in at $1.7 trillion thus far in 2023, Larry said it’s “a more serious problem than it ever has [been] before.” Yes, we know, Larry. I certainly do not have the answer short of a global debt jubilee, but the solutions he offered are DOA. He believes that the additional $85 billion we gifted the IRS to hire an army of jackboots is a great idea. “Seems to me that before we get to painful spending cuts or we raise taxes on anybody under the law, I see overwhelming evidence that by strengthening the work the IRS does we can raise more tax revenue.”

Larry is not dumb and is certainly aware that Biden’s ridiculous proposals to substantially increase taxes on wealthy folks, go after corporations to crush capital gains, tax every transaction on Wall Street and plebes in the stock market, or Bernie Sander’s latest wet dream for taxing income over $1 billion at 100% are false narratives that destroy revenue and economic expansion instead of growing it. The NYSE already implemented an alternative exchange infrastructure in Chicago to exit NJ and NY if a transaction tax is passed.

- Biden’s Math of Just Taxing the Rich Doesn’t Add Up – CATO Institute, Mar. 2023

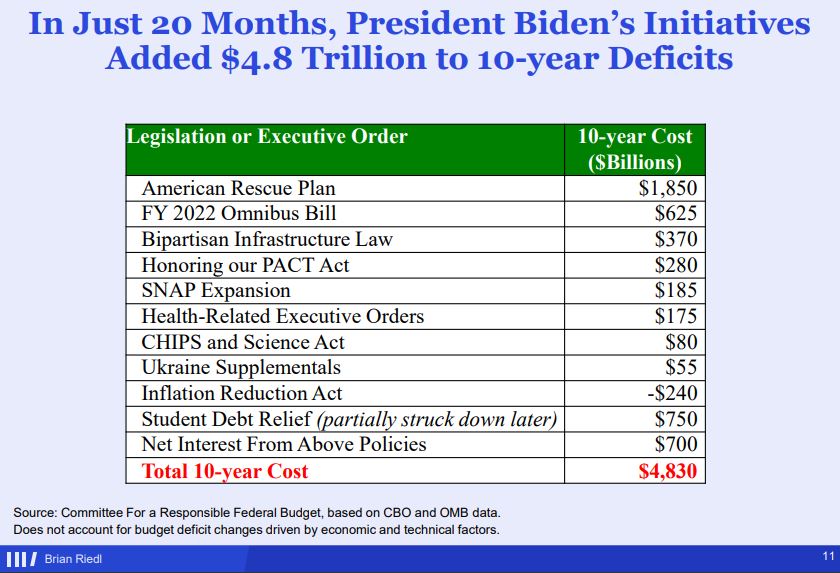

The flavors of taxation and bureaucratic tyranny noted above would not approach anywhere near making a dent in the growing U.S. national debt that is at $33.7 trillion this afternoon as actual federal spending for this year is $6.3 trillion, does not include $211.3 trillion of unfunded liabilities in which 95% are untouchable Social Security and Medicare obligations, and all that manure doesn’t include the exponential rise in annual interest payments coming due on Treasury debt. Consider perusing the ”2023 Chart Book Examines Spending, Taxes, and Deficits” published this month by the Manhattan Institute. Here are two excerpts from that presentation:

Larry Summers also noted that he supports Biden’s Inflation Reduction Act that passed last year. It is theoretically supposed to reduce inflation, the budget deficit, and pay for new investments in clean energy, but even Biden admits that it failed to lower costs for Americans.

- One Year Later, Even President Biden Admits the “Inflation Reduction Act” Failed to Lower Costs for Americans – U.S. House Energy & Commerce Committee, Aug, 16

Someone please communicate to Larry and Biden’s apparatchiks that the Green New Deal and EV dreams are going bust amid The Squad’s policy-driven spending spree in the same way that Obama’s “green” programs sank billions into renewable energy projects that went bankrupt. Remember the Solyndra scandal and the long list of corrupt government financing on our tax dime? But I digress.

Jesse Watters: Biden’s Green New Deal is falling apart – Nov. 2

Nowadays, your tax dollars provide a stipend for millionaire Democrats on Capitol Hill to live in swanky D.C. apartments. Current fiscal policy and decades of corruption out of D.C. are wildly unsustainable and likely to trigger a U.S. debt default much sooner than the Penn Wharton Budget Model assumes. Professor Tim Congdon at the Institute of International Monetary Research explained the explosion of U.S. public debt two weeks ago in a 20-minute video.

I’m closing shop this evening with four assignments for my readership. I cannot stress enough why “The Great Taking” by David Rogers Webb (documentary published Nov. 29) that was published in June 2023 is the most important to inhale asap without delay. The PDF version is provided freely by the author who is a former Wall Street insider that clearly understands how the global financial spaghetti functions and is tied together. Do not pass by the prologue or you will not grasp his roots and why he decided to pen the book. Take note of how important quadrillions in the derivatives market are for executing the end game, just like they were the root cause of the Great Financial Crisis.

“Derivatives are financial contracts on everything imaginable and even unimaginable for most of us. They may be modeled on real things, but are not the real things themselves. They are un-tethered from physical reality… but can be used to take real things as collateral. This is the subterfuge, the endgame of it all.”

Derivatives and the coming collapse w/Alex at Reporterfy – The Duran (video), Oct. 16

The Interest Rate Shock Will Blow Up the Government’s Ponzi Game… “In the international fixed-income markets, interest rates are rising, and the decades-long trend of declining bond yields has undoubtedly been broken.” – Mises Institute, Nov. 6

Stop Drinking the Political Kool-Aid, America: Voting Will Not Save Us… “We are one year out from the 2024 presidential election and as usual, the American people remain eager to be persuaded that a new president in the White House can solve the problems that plague us. Yet what is being staged is not an election. It’s a con game, a scam, a grift, a hustle, a bunko, a swindle, a flimflam, a gaffle, and a bamboozle, and ‘we the people’ are nothing more than marks, suckers, stooges, mugs, rubes, or gulls. We’re being duped.” – Rutherford Institute, Nov. 7

Texas Hippie Coalition – Pissed Off and Mad About It

Plan Your Trade, Trade Your Plan

Headline Collage Art by TraderStef

Not a Financial Advisor: None of the content produced by TraderStef™, staff members, or any services associated with this website should be construed as financial or investment advice. Financial investment is a risky endeavor and may lead to substantial loss. Always perform due diligence before undertaking any financial decision – Copyrighted Material: A “by TraderStef” credit linked back to this website is required when using any quotes, technical analysis charts, or publishing a partial version of an article.

3 thoughts on “Annual Interest Due on U.S. Sovereign Debt Surges Above $1 Trillion”

Comments are closed.